Park City Utah Real Estate Taxes

The office also assesses and collects taxes on business personal property owned and leased mobile homes and mobile offices.

Park city utah real estate taxes. Summit county treasurer treasurer. Thus if the market value of your home is 100 000 the taxable value is just 55 000. There are more than 1 000 different property tax areas in utah each with a separate rate. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Your local tax rates apply to that taxable value. We welcome your comments and suggestions so please email us. Utah property tax rates. Counties in utah collect an average of 0 6 of a property s assesed fair market value as property tax per year.

The median property tax in utah is 1 351 00 per year for a home worth the median value of 224 700 00. 2020 property tax dates. Property values not yet updated. New parcel subdivisions and splits after january 1 2020 will be shown here.

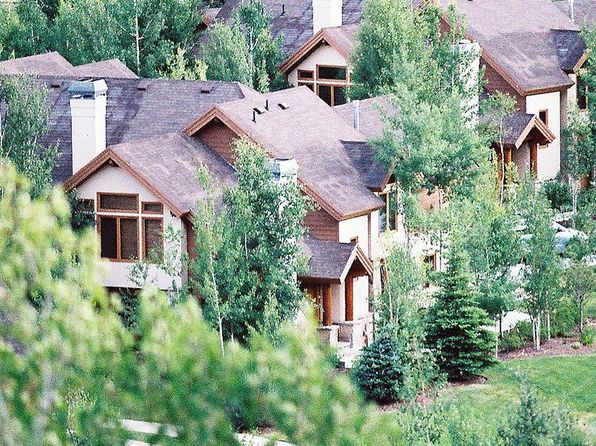

The assessor s office is responsible for the appraisal of real property homes condos recreational parcels vacant land commercial and industrial properties. 2021 tax year lookup service future tax year. Zillow has 731 homes for sale in park city ut. Utah is ranked number thirty two out of the fifty states in order of the average amount of property taxes collected.

Pay past due 2019 taxes to avoid additional penalties interest.